Monday Economic Report - Manufacturing Activity Improves as Inflation Remains a Problem

Date postedJanuary 23, 2025

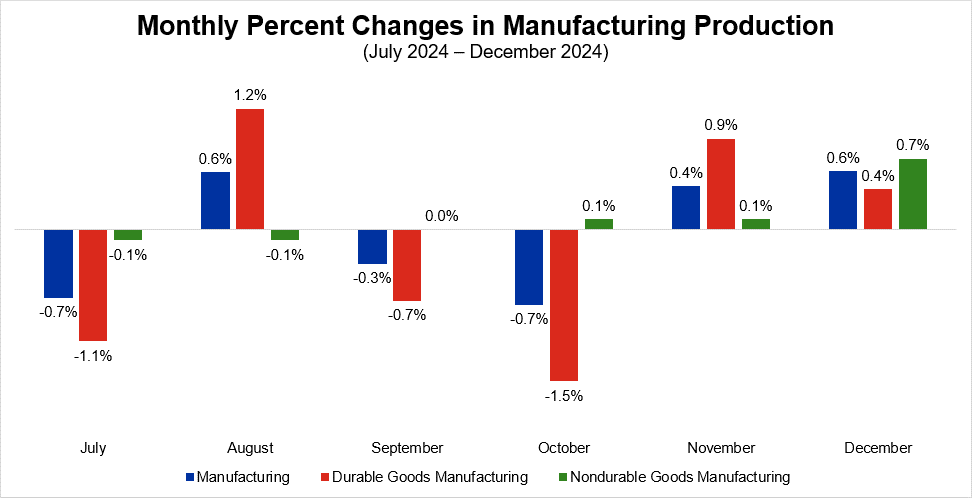

- Rebound in aircraft production exaggerates December industrial production jump: Manufacturing production increased 0.6% in December, with a 6.3% gain in the aerospace and miscellaneous transportation equipment index leading the increase, but manufacturing output was flat over the year.

- What it means: Despite the dramatic over-the-month boost to aerospace and miscellaneous transportation equipment inflating the strength of production in December, decent gains occurred across other manufacturing sectors, providing hope for output in 2025.

- Consumer and producer prices heat up in December: Following a 2.7% over-the-year increase in November, consumer prices rose 0.4% over the month and 2.9% over the year in December. Meanwhile, wholesale prices grew 0.2% over the month and 3.3% over the year in December, the largest rise since the year-over-year increase in February 2023.

- Why it matters: After the Federal Open Market Committee made 75 basis points of cuts in 2024, markets anticipate the FOMC will keep rates steady at its meeting next week as inflationary risks persist, and the job market shows signs of improvement.

- Meanwhile, inflation is starting to outpace earnings for production employees: Real average hourly earnings decreased 0.2% over the month but increased 1.0% over the past year for production and nonsupervisory employees in December. Before adjusting for inflation, average hourly earnings for manufacturing production workers rose 4.5% over the past year in December.

- What it means: While real average hourly earnings for frontline employees are still up over the year, inflation outpaced frontline employees’ earnings in December, exhibiting how recent inflation growth is leading to a decline in employees’ purchasing power.

- Empire State manufacturing remains volatile: Manufacturing activity in New York state weakened in January, with the headline general business activity index retreating 14.7 points to -12.6. Modest declines occurred in both orders and shipments.

- Why it matters: After activity surged in November then moderated in December, the Empire State’s manufacturing activity is down again. Despite the volatility in real-time activity, optimism for future activity rises again.

- While Philadelphia manufacturing activity surged: In January, Philadelphia’s index for current general business activity jumped from a revised -10.9 to 44.3, the highest reading since April 2021. In addition, both the indexes for new orders and shipments surged.

- What it means: Philadelphia’s regional manufacturing activity may be turning a corner finally after a prolonged period of challenges.

Written by: Author Unknown, for the National Association of Manufacturers (NAM)