|

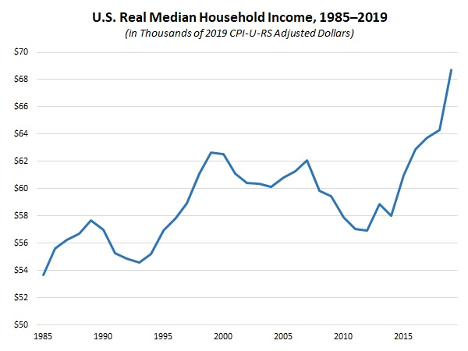

Real Median Household Income Soared to a New Record in 2019

- Real median household income soared to a new record, up 6.8% from $64,324 in 2018 to $68,703 in 2019. The average American working full-time, year-round earned $52,000 in 2019. The official poverty rate was 10.5% in 2019, down for the fourth straight year and down from 11.8% in 2018. For real median household income data by state, click here.

- Manufacturing production increased 1.0% in August, easing from the 3.9% gain seen in July but rising for the fourth straight month. Despite recent progress, output in the sector remained 6.7% below the pre-pandemic pace in February. Manufacturing capacity utilization was 70.2% in August, up from 69.5% in July but still down from 75.2% in February.

- The New York and Philadelphia Federal Reserve Banks each reported expanding manufacturing activity in September, with the sector continuing to show signs of recovery since the spring and orders strengthening in both districts. Respondents were upbeat in their outlook.

- Retail spending rose 0.6% in August, slowing from the 0.9% gain in July but increasing for the fourth straight month. Americans continue to spend modestly, with activity above pre-pandemic levels for the third consecutive month. Over the past 12 months, retail sales have risen 2.6%, but with motor vehicles, parts, and gasoline excluded, spending has increased by a relatively decent 4.0% since August 2019.

- Consumer confidence increased to a six-month high, according to preliminary data from the University of Michigan and Thomson Reuters. However, sentiment remains below pre-pandemic levels.

- New residential construction declined 5.1% to 1,416,000 units at the annual rate in August, but the decrease stemmed entirely from the volatile multifamily segment. More importantly, single-family housing starts rose to 1,021,000 units, the best reading since February. Housing permits edged down 0.9% but remained solid at an annualized 1,470,000 units in August.

- The National Association of Home Builders and Wells Fargo said that the Housing Market Index rose to 83 in September, a new all-time high, with builders very upbeat in their expectations for single-family sales over the next six months.

- The Federal Open Market Committee left interest rates unchanged, as expected, signaling no change in rates for the foreseeable future. The latest economic projections point to the federal funds rate remaining at its current range—zero to 25 basis points—until at least sometime in 2022, reflecting continuing concerns about economic growth and in the outlook.

- FOMC participants upwardly revised their economic outlook for this year relative to their assessments in June. The U.S. economy is now seen declining 3.7% in 2020, an improvement from the 6.5% decrease forecasted three months ago. In addition, the unemployment rate is predicted to fall to 7.6% this year, sharply lower than the 9.3% estimate made in June.

|

|

|

|

|

|

|

|

|

|

|

Written by: Chad Moutray, Ph.D., CBE, for the National Association of Manufacturers.

|