The latest data from the Bureau of Labor Statistics showed disappointing job growth, with the U.S. economy adding just 138,000 net new workers in May, below the consensus estimate of 185,000 and even further from the 253,000 estimate provided by ADP. In addition, there were downward revisions to the March and April data, subtracting a total of 66,000 jobs from those months. There were fewer Americans employed overall, down from 153.2 million in April to 152.9 million in May, a three-month low. As a result, the participation rate dropped from 62.9% to 62.7%, its lowest level since June 2016. With that in mind, the unemployment rate fell once again, down from 4.4 % to 4.3%, a 10-year low. Likewise, the so-called “real” unemployment rate declined from 8.6% to 8.4%, a level not seen since November 2007.

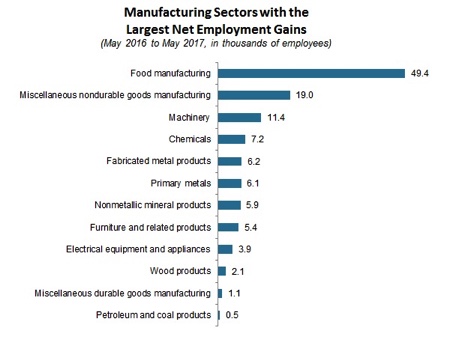

Meanwhile, manufacturers were hoping to have a sixth straight month of job gains, much as we saw in the ADP data. Instead, manufacturing employment fell by 1,000 workers in May. On the positive side, revisions to March and April data added another 3,000 employees to what was estimated previously. Overall, manufacturing employment has averaged 12,167 per month since December, which stands in sharp contrast to the loss of 16,000 workers on net in 2016 as a whole. As such, even with the slight decline in May employment for the sector, the general trend for manufacturing employment over the past six months has been favorable. We have seen higher expectations for job growth of late in light of a stronger outlook for demand and production.

Along those lines, the Institute for Supply Management’s Manufacturing Purchasing Managers’ Index reported that growth in activity remained essentially the same in May. The composite index edged marginally higher, and it was the ninth consecutive monthly expansion in manufacturing activity in the United States, with the sector showing signs of progress after two years of notable challenges. Both new orders and employment grew at a faster pace in May (differing from the Bureau of Labor Statistics data described above), with relatively strong demand in the sector. In contrast, production and exports both eased for the month, even as they remained promising. In addition, prices for raw materials continued to increase strongly, but that measure has slowed since March’s pace, which was the quickest rate since May 2011. Beyond the national figure, we learned that manufacturing activity in the Dallas Federal Reserve Bank’s district accelerated in May and expanded for the eighth straight month. As such, that region has made significant progress from contracting conditions as recently as September.

With that said, there are some lingering challenges of note. Private manufacturing construction spending pulled back once again. The value of construction put in place in the sector declined 1.9% in April to its slowest pace since October 2014. While manufacturing construction has trended mostly higher over the past few years, activity has moved lower since achieving an all-time high in September 2015. Nonetheless, we would expect a turnaround in construction activity in the coming months, especially in light of the improved outlook of late.

Moreover, the trade picture provided mixed levels of comfort. Encouragingly, manufacturing exports have trended in the right direction in the early months of this year—a welcome development after weaker data in each of the past two years. Using non-seasonally adjusted data, U.S.-manufactured goods exports have increased 3.4% year to date through April relative to the same time period last year. Yet, the U.S. trade deficit rose to a three-month high, with reduced goods exports and a pickup in goods imports. Interestingly, the petroleum trade deficit fell to its lowest level since September. Therefore, the uptick in April’s trade deficit primarily came from the nonpetroleum deficit, which grew to a level not seen since March 2015.

Turning to consumers, personal spending rebounded modestly in April after declining slightly in March. We have seen spending pull back from more robust growth at the end of 2016, but the most recent data suggest Americans have begun to open their pocketbooks once more, albeit still cautiously. The year-over-year data indicate decent growth overall in consumer demand, with personal spending up 4.3% since April 2016. That was down from 5.0% in the prior release but up from 3.8% one year ago. For its part, the saving rate was unchanged at 5.3%. Personal incomes rose 0.4% in April, with manufacturing wages and salaries up 2.6% over the past 12 months. In addition, the Conference Board reported that consumer confidence remained elevated in April despite easing for the second straight month.

After a busy few weeks of economic releases, there will be just a trickle of new indicators out this week. Highlights include new figures on consumer credit, factory orders and shipments, job openings and productivity.

Article written by Chad Moutray, Ph.D., CBE, Chief Economi Chief Economist - National Association of Manufacturers